Financial crime proliferates within the intricate world of finance, where substantial sums of money swiftly change hands across borders. For regulators and financial institutions, the ongoing challenge lies in combating various threats, from sophisticated fraud to money laundering schemes. These wrongdoers grow increasingly intelligent and tech-savvy day by day. Artificial intelligence and neural networks can be instrumental in addressing this issue. They aid us in confronting these elusive and cunning offenders, much like the high-tech investigators within the finance industry. In this blog, we’ll delve into the captivating field of anti-money laundering (AML) and demonstrate how neural networks collaborate with us to unravel financial crime mysteries. Consider it a guided tour through the digital battlefield, where technological advances are revolutionizing our approach to combating financial malfeasance.

Introduction to Financial Crime and AML

The banking industry faces a constant threat from financial crime, which includes a variety of acts like money laundering, fraud, corruption, and more. The severity of this problem is highlighted by the estimate of $2 trillion that is laundered globally each year, according to the United Nations Office on Drugs and Crime.

It is impossible to exaggerate the importance of this problem. Financial crime directly threatens the stability of the national and international financial systems since it destroys the integrity of economic systems and reduces trust in economies.

Consider a large financial institution unknowingly facilitating the cross-border transfer of millions of dollars for an international drug syndicate through money laundering, concealing the funds’ illicit origins. The primary goal of Anti-Money Laundering (AML) efforts is to detect and prevent such operations, safeguarding the integrity of the financial industry.

Inspired by the intricacies of the human brain, neural networks are changing AML by analyzing massive datasets at new rates and discovering nuanced patterns that typically avoid human investigators.

In the following sections, we’ll look at how these technologies improve our ability to identify financial crime secrets, providing a view into a future when financial criminals find it increasingly more complex to avoid detection.

Evolution of Financial Crime

Financial crime has been around for as long as economic systems have; it is not a relatively new issue. Fraudulent schemes date back to the beginning of commerce. Examples of dishonest business operations and counterfeit money can be found going back to the Roman Empire and beyond. Financial crimes developed in sophistication as society advanced. Insider trading, Ponzi schemes, and different forms of theft became commonplace as modern banking and international trade flourished in the 19th century. The emergence of new financial instruments and stock exchanges also stimulated criminal creativity.

Financial criminals have adapted to new opportunities in today’s technologically advanced and interconnected world. They have used technical developments to carry out intricate, cross-border crimes. Hacking, identity theft, and online fraud are examples of cybercrime, which has grown to be a severe problem. These days, criminals can operate anywhere worldwide and target financial institutions, businesses, and individuals. Due to cryptocurrencies’ secrecy and decentralization, they have opened up new channels for illicit activity and money laundering. From drug trafficking to the sale of financial data that has been stolen, the dark web offers a covert market for a variety of illegal operations.

Financial crime is still developing at a rapid pace as of 2023. The complex and subtle strategies employed by criminals have increased in response to the rapid breakthroughs in artificial intelligence, blockchain technology, and data analytics. It is getting harder and harder to tell the difference between real and fraudulent activity due to the prevalence of deepfakes and AI-driven social engineering tactics. Innovative solutions are necessary for financial institutions to keep ahead of illicit businesses as they encounter new and challenging situations. We will examine in the ensuing sections how these contemporary forms of financial crime are being combated, with artificial intelligence and neural networks—two technological innovations at the vanguard of the fight—proving to be crucial.

Role of Neural Network in AML

Neural networks are essential for AML because they can handle and analyze large amounts of financial data faster than traditional approaches. Intricate patterns and irregularities in this data are easily recognized by neural networks, enabling them to find minute but important clues of possible money laundering or fraudulent activity. Unlike rule-based systems, which could miss intricate and dynamic plans, neural networks adjust and develop to match the ever-changing strategies used by financial criminals.

At the core of neural networks in AML is applying both machine learning and deep learning techniques. The system can learn from past data, identify patterns, and provide predictions or classifications based on this acquired knowledge. A subset of machine learning known as “deep learning” takes one step further by using multiple-layered neural networks, or “deep neural networks.” These layers improve the system’s capacity to recognize complicated links within the data by enabling it to learn and represent complex hierarchical features automatically.

In the context of AML, transactional data, customer profiles, and other financial information are analyzed by machine learning and deep learning algorithms inside neural networks. These algorithms aid in the early detection of illicit behavior by recognizing patterns connected to illegal activity. They are essential weapons in the battle against financial crime because of their ability to adapt and change with the constantly evolving tactics used by financial criminals.

Building an AML Neural Network

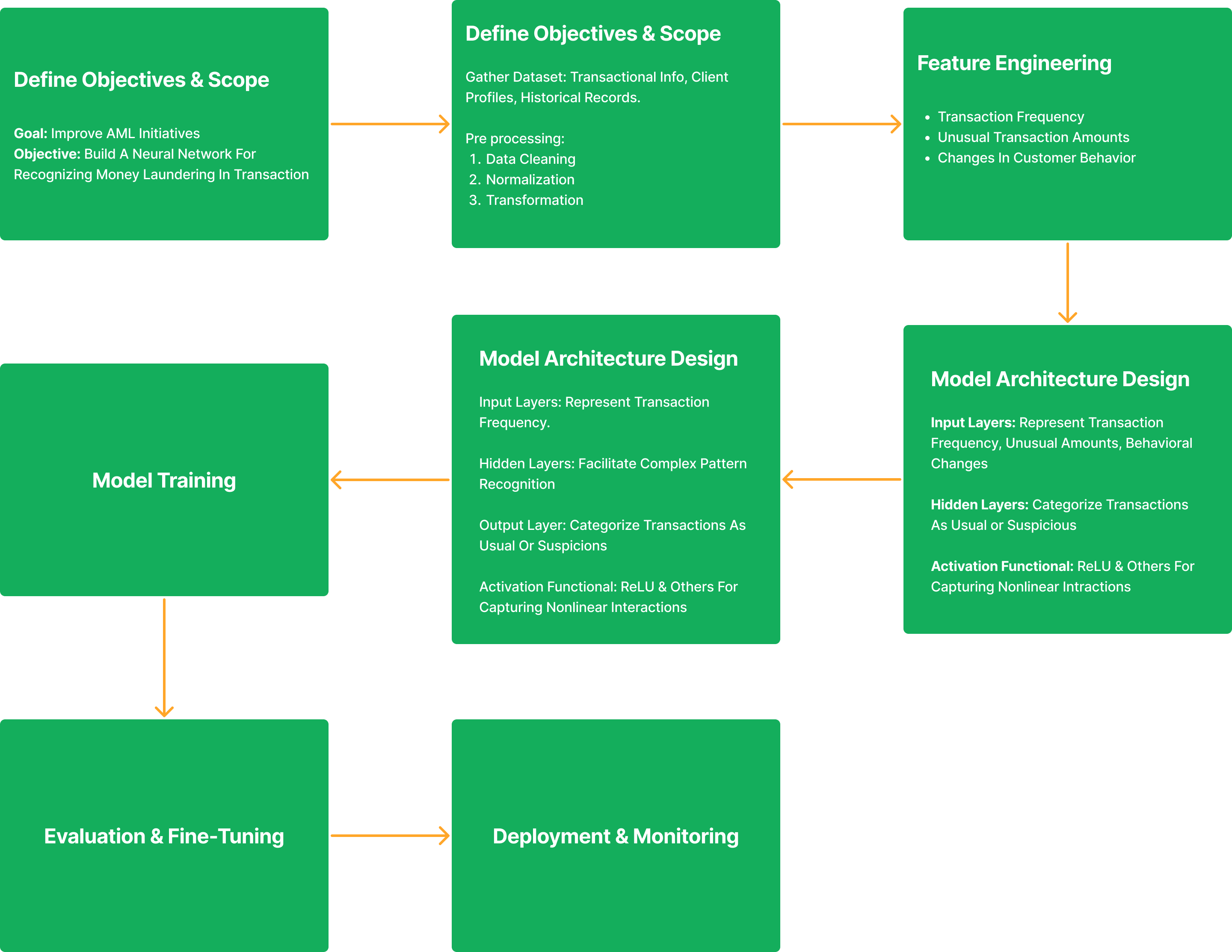

Step 1: Define Objectives and Scope

Think of a global bank that wants to improve its AML initiatives. The goal is to build a neural network to recognize possible money laundering activity in various transactions, such as credit card purchases, ATM withdrawals, and online transfers.

Step 2: Data Collection and Preprocessing

The bank gathers a vast dataset of transactional information, client profiles, and historical records. Preprocessing includes a complete data cleaning to correct inconsistencies, normalization to guarantee uniform formatting, and transformation to provide consistency for all transactions.

Step 3: Feature Engineering

Determine the essential properties of neural networks. Some instances are:

- Transaction Frequency: Recognizing transactions that seem abnormally frequent, as this may point to attempts to conceal illegal activity.

- Unusual Transaction Amounts: Tracking down transactions that substantially depart from a client’s customary spending patterns.

- Changes in Customer Behavior: Seeing abrupt adjustments to a customer’s transactional habits could indicate attempts to launder money.

Step 4: Algorithm Selection

A deep neural network is used due to the intricacy of financial transactions and the requirement for pattern identification. Its capacity to discover complex connections within the data is consistent with the subtleties of money laundering trends.

Step 5: Model Architecture Design

Input layers of the deep neural network are designed to represent information such as transaction frequency, odd amounts, and behavioral changes. Several hidden layers make Complex pattern recognition easier, and the output layer categorizes transactions as usual or suspicious. ReLU and other activation functions are selected because they are good at capturing nonlinear interactions.

Step 6: Model Training

The bank uses past data marked with confirmed money laundering cases to train the AML neural network. Using backpropagation, the model modifies its parameters to reduce the discrepancy between expected and observed results. Through training, the network becomes more adept at identifying minute patterns that point to potential money laundering.

Step 7: Evaluation and Fine-Tuning

A validation dataset subjects the neural network to a rigorous evaluation process. Several metrics include the receiver operating characteristic (ROC) curve, recall, and precision. Achieving optimal performance requires fine-tuning hyperparameters, like learning rates. For example, modifications are performed to lower the percentage of false positives while preserving sensitivity to real positives if the model shows a high rate of false positives.

Step 8: Deployment and Monitoring

After attaining favorable outcomes, the bank integrates the AML neural network into its transaction monitoring system. Ongoing observation guarantees that the model adjusts to new methods of money laundering. For instance, the model is updated and retrained to maintain its efficacy if criminal behavior changes, such as when they use new channels for unlawful transactions.

Technologies to Build the AML Neural Network System

- Python: Ease of use, Extensive libraries

- Machine Learning Libraries and Frameworks (TensorFlow, PyTorch, scikit-learn): Flexibility in designing, training, and deploying neural networks.

- Deep Learning Frameworks (Keras, MXNet): Provide high-level abstractions, simplifying the process of building complex neural network architecture.

- Data Preprocessing Tools (Pandas, NumPy): Enable data manipulation, cleaning, and transformation, Important for preparing datasets for neural network training.

- Data Visualization Tools (Matplotlib, Seaborn, TensorBoard): Understand data patterns, facilitating informed decisions during the development process. TensorBoard allows real-time monitoring of neural network training.

- Database Technologies (SQL and NoSQL): Retrieve structured and unstructured data, Handle large volumes of financial transaction data.

- Cloud Computing Services (AWS, Azure, GCP): Containerization and Orchestration (Docker, Kubernetes)

- Explainable AI (XAI) Tools (LIME, SHAP)

- Cybersecurity Tools (IDS, Firewalls, Security Protocols): Threat Detection, Data Integration

Real-world AML Neural Network System

Actimize

NICE Actimize is a leader in fighting financial crimes by using advanced technology like machine learning and artificial intelligence, including neural networks. Their technology lets them use cool features, such as smart machine learning models and detailed analytics, to catch and prevent financial crimes. Actimize has its own issues and limits. It can be expensive for smaller banks to use and keep up this advanced technology. Also, understanding the results from machine learning can be tough, so it’s important to make sure regular people can understand what’s going on with these complicated algorithms.

Oracle Financial Services Analytical Applications

It provides a strong foundation for risk management, compliance, and performance optimization by integrating deep learning, machine learning, and advanced analytics. With capabilities like client risk profile, risk-based alert prioritization, and adaptive learning, the system shines and gives financial institutions advanced tools to manage financial risk. Strong analytical skills and compliance features are among its strong points; however, implementation complexity and the demand for constant upgrades to satisfy changing regulatory standards could be disadvantages. Still, OFSAA is a flexible and cutting-edge option for organizations looking for tools for risk management and thorough financial analytics.

Mantas AML

Mantas AML is a specialist solution created to fight money laundering in the finance sector. With cutting-edge technology like neural networks and machine learning, Mantas AML provides powerful capabilities for regulatory reporting, customer due diligence, and transaction monitoring. Its main strength is its capacity to evaluate big datasets and adjust to new patterns via adaptive learning mechanisms, improving detection accuracy. Although it has received accolades for its extensive analytics and behavioral profiling capabilities, there may be drawbacks, such as requiring specialized staff for efficient implementation and continuous maintenance. Organizations using Mantas AML to prevent financial crimes constantly must balance the sensitivity and specificity of their approach to reduce false positives.

QuantaVerse AML Model

The QuantaVerse AML Model enhances AML efforts by utilizing cutting-edge technology, including artificial intelligence, machine learning, and neural networks. The model is highly effective in detecting and stopping possible money laundering operations because of its features, which include anomaly detection, extensive dataset analysis, and adaptive learning. However, the intricacy of incorporating sophisticated machine learning models could provide difficulties during the implementation stage, and the interpretability of the outcomes could make it harder to comprehend intricate algorithmic choices. Limiting false positives by finding the ideal mix between specificity and sensitivity is also critical. Despite these factors, QuantaVerse’s AML Model continues to lead the way in utilizing cutting-edge technology for efficient financial crime detection.

Strategic Future Implementations

Strategic considerations are essential to improve the efficacy of Neural Network AML systems in the future. It is imperative to prioritize transparency and adopt improved interpretability techniques, particularly emphasizing Explainable AI technology. This feature aims to give compliance workers and investigators clear explanations so they may feel confident in the model’s findings. Resolving the ongoing issue of false positives calls for a more advanced strategy. Contextual comprehension can be improved by sophisticated rules engines and NLP breakthroughs, which will significantly lower false positives linked to regular but unique financial activity. Future Neural Network AML systems will require continual learning mechanisms, a critical strategic priority.

Real-time adaptation and autonomy against shifting dangers are ensured by creating algorithms that explore reinforcement learning approaches, adjust to changing patterns, and actively seek out emerging trends. A key tactic that emphasizes the synergy between AI models and human investigators is human-in-the-loop collaboration. Researchers may give input by putting human-in-the-loop devices into place, gradually improving the model’s comprehension. This cooperative strategy reduces the burden of false-positive investigations while optimizing the use of human expertise. The strategic integration of blockchain technology is critical to strengthening data security.

By utilizing the transparent and secure ledger of blockchain technology, issues pertaining to tampering or illegal access are addressed, guaranteeing the accuracy of transaction data. Better explanations for model predictions, increased transparency, and increased trust in flagged transactions depend on developing XAI technologies. Concurrently, investigating developments in NLP greatly aids in decreasing false positives and improving the precision of the AML system. Enhancing behavioral analytics skills is a wise investment as it makes it possible to spot complex irregularities and suspicious trends.

This entails using sophisticated algorithms to identify subtle behavioral cues linked to potential financial crimes. Using dynamic rule modifications driven by continuous learning is a dynamic strategy. Less manual intervention is required by enabling rule engines to adjust dynamically to evolving trends and patterns, resulting in long-term efficacy. Strategic integration presents potential benefits in handling complex computations more effectively as Quantum Computing develops. AML systems could be revolutionized by quantum computing’s ability to increase processing power, allowing for faster analysis of large datasets.

Conclusion

In the blog, we explore the pivotal role of AI and neural networks in countering financial crime. Financial crime, estimated at $2 trillion globally, remains a persistent threat, evolving with technology. AML becomes crucial in this context. The evolution of financial crime from historical origins to 2023 is outlined, highlighting the adaptability of criminals to technological advancements. Neural networks in AML prove essential, processing vast financial data for early detection through machine learning and deep learning.

The blog details the process of building an AML neural network, emphasizing key technologies. Real-world AML systems like Actimize, Oracle, Mantas, and QuantaVerse are discussed, considering their features and drawbacks. Strategic future implementations focus on interpretability, mitigating false positives, continuous learning, human-in-the-loop collaboration, blockchain integration, and Explainable AI. These strategies collectively enhance the accuracy and adaptability of AML systems in combating evolving financial crime.